Table of Contents

In the beginning of the pandemic, we created an emergency response system on Thomasnet.com that connected manufacturers of PPE-related products with front-line organizations. A system impactful enough to have Congress recommend Thomasnet.com as a critical resource to the Manufacturing Caucus — second to FEMA.

These efforts weren’t a coincidence. Thomasnet.com is a multi-sided platform that matches industrial buyers with industrial suppliers. We were uniquely positioned to pivot and design a user experience that connected two groups of users critical to aiding pandemic relief efforts and ultimately saving lives.

This article is a comprehensive guide on designing multi-sided platforms based on the culmination of my five years as the head of product design and experimentation of Thomasnet.com.

I begin by setting a baseline understanding of multi-sided platforms; I then take a deep dive on designing the matchmaking experience; followed by a focus on retention and growth; and last, I end the with one of the most critical yet often overlooked topics, measuring success.

I hope you find this useful — I know future me will.

An Introduction to Multi-Sided Platforms #

A multi-sided platform is a digital marketplace that enables the exchange of goods, services, or information between producers and consumers. It’s the digital equivalent of a mall that connects buyers with sellers or a nightclub that facilitates matches between single folks.

Platforms have gained immense popularity over the last decade because of the introduction of real-time and on-demand capabilities enabled by the supercomputers we carry around in our pockets — which, technically, are also platforms.

Nevertheless, multi-sided platforms have been around for some time. Thomasnet.com, for example, has been around since 1898. Their focus a century ago is the same as today, connecting industrial buyers with industrial suppliers. However, they did this via heavy physical books distributed across the United States.

Multi-Sided Platforms vs. Traditional Pipeline Businesses #

The term multi-sided platform is typically used to describe business models when differentiating from the traditional pipeline business. Multi-sided platforms decentralize the service & product suppliers, whereas pipeline businesses are the service or product suppliers.

However, what may seem like a business model subtlety has profound implications on the user experience.

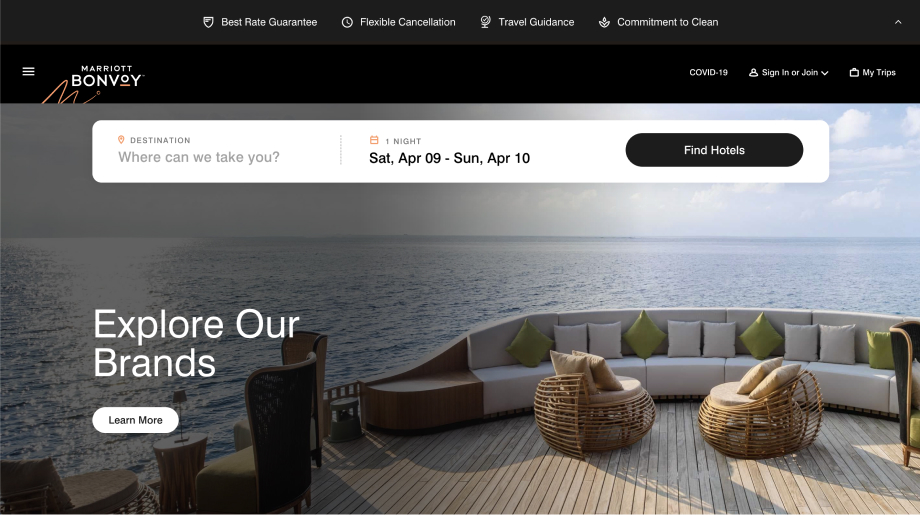

Take, for example, Marriot.com, a traditional pipeline business and one of the world’s largest lodging providers, owning thousands of hotel properties.

Marriot.com — Traditional Pipeline Business #

Their success is contingent on the number of nights booked (demand) at the hotels they own (supply). Their website’s user experience and value proposition focus on getting potential guests to book a stay.

A traditional funnel experience works here — the more qualified users they attract to their website, the more likely bookings will take place. They work with a consistent level of supply which doesn’t fluctuate beyond their control.

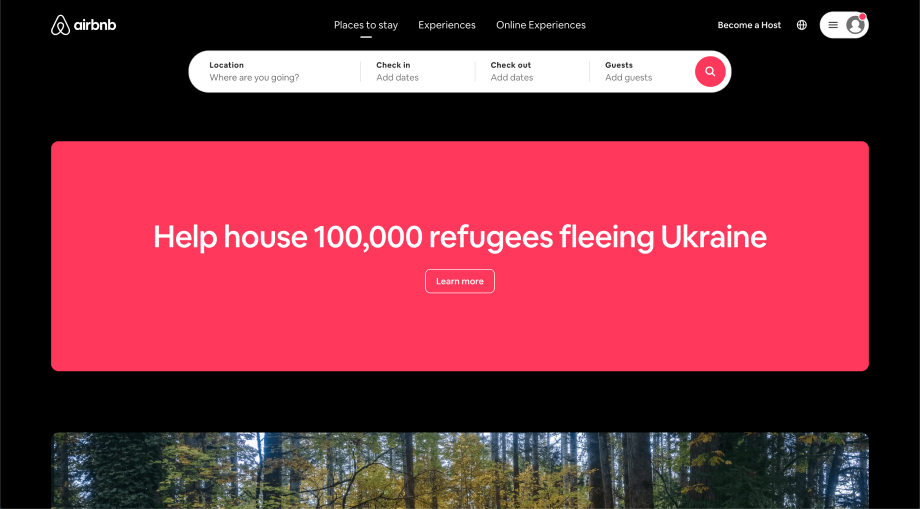

Now let’s take a look at Airbnb.com — a multi-sided platform and the largest lodging provider in the world, yet they do not own a single property.

Airbnb.com — Multi-Sided Platform #

Their success is contingent on the number of nights booked at the properties listed on their platform. Airbnb plays the role of the matchmaker in the short-term rental industry between guests and property owners.

Not only is their website’s user experience designed for users looking to book a stay AND users looking to become a host, but also primarily optimized for getting two strangers to trust each other and transact.

The traditional funnel approach goes out the window for platforms when you realize that attracting the right consumers depends on attracting the right producers. And to attract the right producers, you’ll have to attract the right consumers.

Ladies and gents, this is what we’ve historically called the chicken and egg problem — known officially as the Network Effect.

The Network Effect #

According to Geoffrey Parker and Marshall Van Alstyne in Platform Revolution: How Networked Markets Are Transforming the Economy, the network effect is the impact the number of users a platform has on the value created for each user. The more compatible users a network has, the more valuable a platform becomes for its users. This is the main differentiator between traditional pipeline businesses and multi-sided platforms.

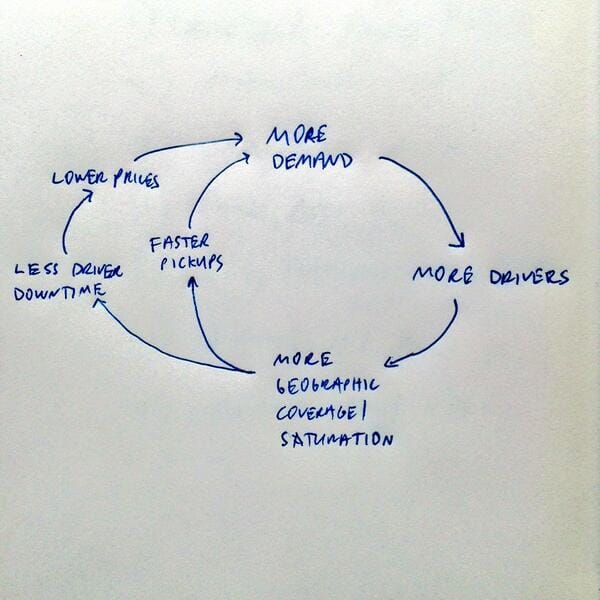

David Sacks, a cofounder of Yammer, famously tweeted the following napkin sketch illustrating Uber’s network effect:

Uber's Network Effect Sketch by David Sacks, Cofounder of Yammer #

More demand for rides will attract more drivers; having more drivers will create greater geographic coverage and therefore increase the demand for rides.

For example, the value Thomasnet.com provides to active suppliers is based on the number of active buyers on the platform. Growing our buyer base increases the value for our suppliers and vice versa. This is commonly referred to as a cross-side network effect.

However, only growing suppliers means that each supplier gets a smaller piece of the pie. Only growing buyers means there is less supply available. This is known as a same-side network effect.

Balanced growth between the two sides of a platform leads to a positive network effect where the value created leads to exponential growth. If unchecked growth takes place or if too many unwanted users join a platform (e.g., spammers), a platform may see the results of negative network effects.

(I go deeper into the topics of active buyer to seller ratio and unchecked growth in the success metrics section.)

The Baseline Structure of a Multi-Sided Platform #

Platforms vary drastically depending on the objective and what’s being exchanged; however, all platforms consist of the following four parts:

Value Unit #

The information, goods, services, or software exchanged on a platform. The value unit of OpenTable is a reservation at a restaurant, a booking for Airbnb, a ride for Lyft, etc. Compared to the traditional pipeline business, platforms do not carry the responsibility of directly producing the value unit.

Participants #

Users participating in the exchange of information, goods, or services enabled by the platform. Users are mainly categorized as producers, users that create the value unit; consumers, users in need of the value unit; and partners, who join the platform to provide additional value to producers and consumers (usually for a premium).

The terminology used to reference producers and consumers vary across platforms. A common alternative for producers are: sellers, suppliers, drivers, makers, and developers; and for consumers: buyers, customers, riders, shoppers, players, and users.

Core Transaction #

The successful exchange of the value unit between producers and consumers — interchangeably referred to as core interaction. From a business perspective, the sole purpose of a platform is to enable and monetize the core transaction.

Matchmaking Tools #

Tools provided by the platform which facilitate and optimize the match between producers and consumers. These could be as simple as a search filter that lets you narrow down the results of what you’re looking for or as intricate as a recommendation engine with a sophisticated algorithm that knows what you’re looking for.

For the most part, matchmaking tools focus on searching for the value unit.

Types of Multi-Sided Platforms #

While the platform’s structure and omnipresent network effect remain consistent, the value unit, objectives, and users vary considerably across different platform types. This variation largely influences how we design the necessary matchmaking experience.

Keep in mind that there’s more than one way to peel an orange — I will be focusing on the categorization of platforms based on the value unit being exchanged. Even with this approach, each platform type could be broken down into distinct subcategories.

Product Exchange Platforms #

The most common platform type enabling producers to sell tangible products to consumers. Yup, the Amazons & Etsys of the world and digital counterparts to malls. Measuring the matchmaking success of these platforms is straightforward since there’s a monetary transaction that takes place when a match is made.

Examples of Product Exchange Platforms #

Service Exchange Platforms #

Platforms focused on enabling the match between a consumer looking for a service and a producer with the ability to provide that service. Taskrabbit, for example, is a platform that matches users needing miscellaneous tasks done with local freelance labor looking to perform these tasks.

Similar to product exchange platforms, a monetary transaction measures the matchmaking success of these platforms. However, because repeat transactions are more common, there’s a larger dependency on user satisfaction post transaction — usually measured through ratings paired with user feedback.

What makes service exchange platforms so popular is the real-time and on-demand capabilities provided by today’s technology platforms.

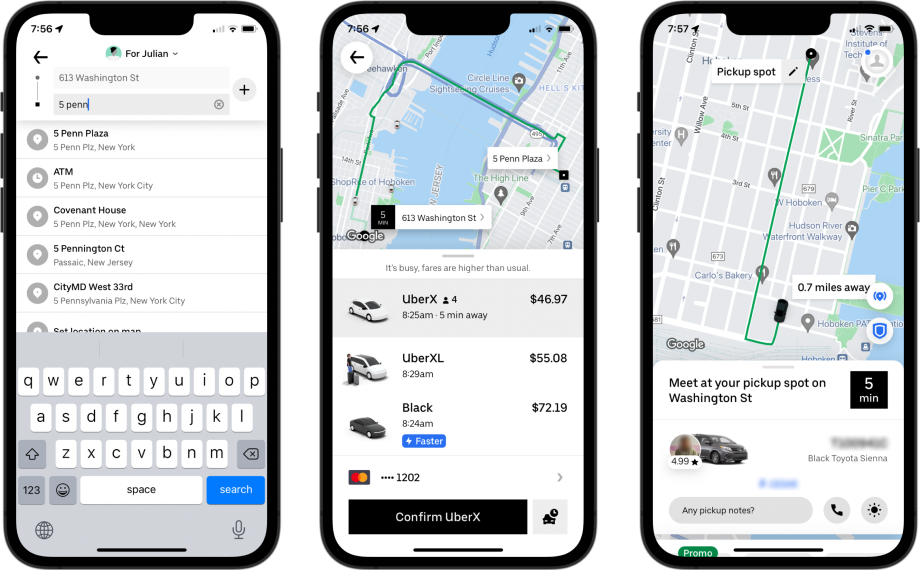

For example, if I need a ride to the airport, instead of looking up a cab company’s number and requesting a ride from an operator, I just open up my phone, enter the address where I want to go, and I instantly get matched with a reputable driver that’s willing to take me there.

Examples of Service Exchange Platforms #

Information Exchange Platforms #

These are platforms that enable the exchange of information between an interchangeable group of producers and consumers with the purpose to inform, entertain, or create a relationship. These platforms vary from social networks (e.g., Facebook, Instagram, TikTok, etc.) to relationship-building platforms of Match.com & Tinder and everything in between.

Because the core transaction in information platforms doesn’t include a direct monetary exchange between users, matchmaking success becomes a bit more complicated, but not impossible, to track.

Most social networks depend on the size of their active user base to attract high-paying advertisers (the “partners”). In comparison, relationship-building platforms depend on paid user subscriptions, increasing the likelihood of users being matched.

Examples of Information Exchange Platforms #

Software Exchange Platforms #

A software exchange platform — sometimes referred to as innovation, technology, or maker platforms — facilitates the creation and exchange of software between developers and users. The device and operating system you’re currently reading this article on is a software exchange platform (so meta).

Part of the iPhone’s success is attributed to the third-party apps available in the App Store and their ability to do just about anything. The Xbox is successful because of the exclusive games the platform offers (let’s face it, they got where they got because of Halo: CE).

(Although most of this article is relevant to software exchange platforms, this only scratches the surface of what’s necessary to design successful ecosystems.)

Examples of Software Exchange Platforms #

Hopefully, that was enough of a baseline on multi-sided platforms to hit the ground running (if not, I included resources at the end of this article for a deeper dive). Now let’s get our hands dirty with designing the end-to-end platform experience.

Designing the Core Transaction #

An effectively designed platform does three things exceptionally well:

- Matches the right consumers with the right producers.

- Establishes the trust needed between consumers and producers to transact.

- Provide the tools necessary to complete the transaction.

The reality is that you can find everything on Google and purchase (mostly) everything on Amazon. However, because these platforms cater to a broad audience with many use cases, they need to provide a broad user experience. This is where smaller platforms gain the upper hand — narrowing down on a specific use case for an optimized user experience.

Step 1: Matching the Right Consumers with the Right Producers #

Matchmaking sits at the crossroads of data science, software engineering, and product design. A seamless matchmaking experience between producers and consumers is an optimized balance between high match value and minimal user effort.

The utopian UX is not to interact with a platform at all. If you’re looking for a ride, you walk to the street and your rideshare is waiting. Since we’re decades, if not centuries, away from “intuition UX” (we might’ve just coined a term), our second-best option relies on a combination of what users tell us, what they allow us to know about them, and context.

Note: Matchmaking is an experience that’s heavily reliant on information retrieval and recommendation engines — two vast topics that won’t be covered in depth within the scope of this article.

Search-Based Matchmaking #

The most common and user-validated way of matchmaking is through a traditional search experience. The buyer lets the platform know what they’re looking for, and the platform returns a set of results. Filters allow users to increase their match value by narrowing down the criteria provided.

This approach has historically worked because it provides a level of options and discoverability to the buyer — the better the search algorithm, the higher the match value. However, there are use cases where the matchmaking experience is laser-focused on the ability to complete the task at hand, and cost — discoverability and options take a back seat.

We retrieve the information we need from Uber’s platform by telling the app where we want to go. Uber then returns a single result that solves the problem for us.

One-to-one Search-Based Matchmaking — Uber #

This is a common matchmaking experience for service exchange platforms considering the broad use case is more focused on the ability to provide a reliable service based on the specifications provided. This use case gives the platform the ability to return a result with a high match value.

As we make advances in machine learning and artificial intelligence, we’ll rely more on high match-value search experiences allowing us to bypass the fatty offerings and get faster to the meaty parts of what we’re searching for.

Feed-Based Matchmaking #

Most information exchange platforms leverage a feed to present users with the information they’re looking for based on their profiles and preferences.

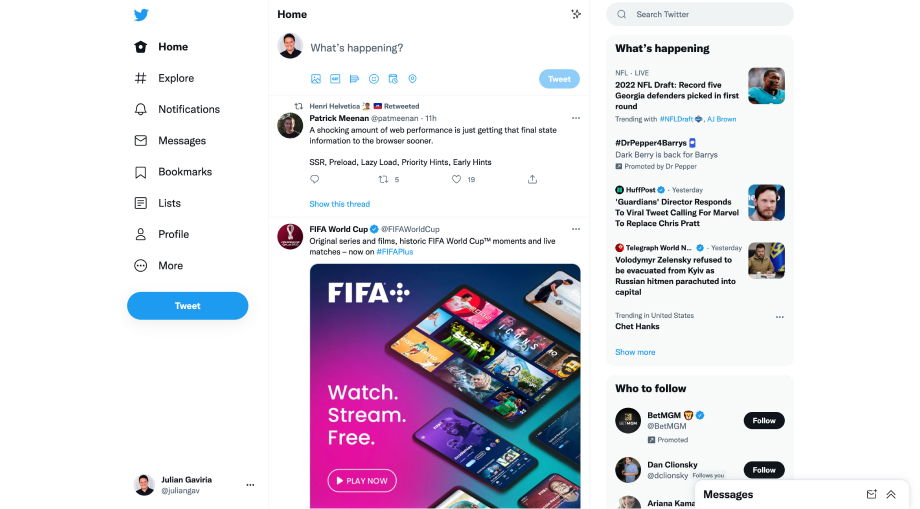

Twitter provides you with a feed based on the topics and people you follow. But in case you are looking for either a specific topic or person, Twitter provides the ability to search manually — this topic or person of interest then makes its way into your feed’s algorithm.

Feed-Based Matchmaking — Twitter.com #

Match.com uses a feed to present potential matches based on the information you provided about yourself and your preferred criteria of the person you’re looking to match with. Tinder revolutionized this by introducing the swipe experience to accept or decline matches. Keyword-based searches are not part of the core experience.

Recommendation Engines & Algorithms #

A recommendation engine is the criteria used to provide suggestions to users, allowing them to discover related value units at the right touchpoint in their user journey. The recommended value units either complement what they’re looking for or more efficiently solve the problem.

There’s ever-present friction between growing revenue and designing with the user’s best interest in mind in information exchange platforms with an advertising-focused revenue model (e.g., social networks that serve ads). The more time consumers spend scrolling, tapping or swiping through content generated by producers, the more revenue advertisers generate; the fewer restrictions given to advertisers, the more they will spend.

Because this approach is focused on interacting with users in their most seducible moments, it can be (and is) easily misused. Just be a good human, please.

Step 2: Establish the trust needed between consumers and producers to transact #

After users have found what they’re looking for, they need reassurance that if they proceed with a transaction or exchange of information, the user on the other side will follow through as promised.

Offline, it’s easy, you go to a mall and you try on clothes — you trust that the shirt you just tried on will look the same once you purchase it and wear it outside of the mall. However, with online transactions, things get a bit more complicated because not only are you not able to see the value unit with your own eyes, but you’re also dealing with a complete stranger. There’s good reason to be skeptical. So how do you build trust?

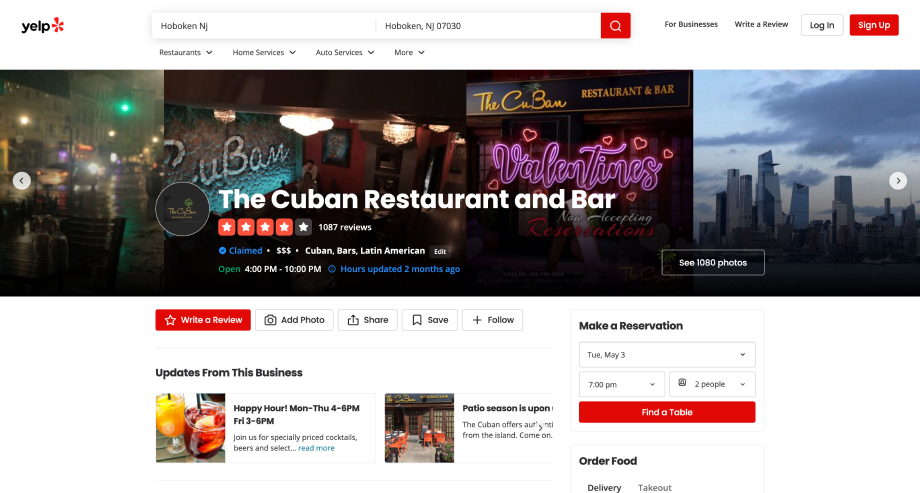

A user experience focused on building trust — Yelp.com #

Reviews & Ratings — Reputation Validation by Peers #

There’s a reason why Uber emphasizes their rating system — it’s because users want to know from other users how their experience was with this user. A rating system builds trust and sets expectations between participants.

A well-designed rating system also gives platform managers the insights necessary to govern their platform and remove users that don’t have good intentions or are a potential liability to the platform brand.

Past Transaction Metrics — Reputation Validation by Experience #

Users will trust a transaction by someone that has performed this transaction multiple times — in the offline world we call this experience. Depending on the type of platform and the respective business model, sometimes peer reviews and ratings cannot be provided. In cases like these, the platform has the option to let users know how much experience this user has with the respective transaction. Users react to metrics like total completed transactions, average response time, and time on the platform.

Paid Subscriptions — Reputation Validation by Platform #

Platforms can also decide to select specific consumers or producers (usually seen on the producer side) that they consider valuable and trustworthy. Although this is intended to promote trust, users have caught on to the fact that most of these approaches are the result of users paying a premium to achieve such status. Depending on the industry, this may promote the intended trust.

In most cases, users also can provide company information, credentials, or certifications that allow them to make a case for themselves. How far the platform goes to validate these claims directly impacts the trust users will have in these claims and the trust of the platform in general.

High-Fidelity Photos & Videos #

High-fidelity photography or videos of the value unit is the deciding factor for users on most platforms. It’s something Airbnb takes so seriously that they provide free photography services for their hosts. They discovered early on that properties with professional photography booked two and a half more listings than those without.

Step 3: Provide the tools necessary for users to transact #

Once users are matched and a level of trust is established, it’s now up to the platform to make it as easy as possible for the transaction to take place.

Money Exchange #

In platforms where money is exchanged, transacting through the platform is preferred by users due to convenience and assurance. If the exchange goes wrong, platforms have safety measures that allow for refunds. However, this convenience comes at a price since most platforms take a percentage of the transaction. Unreasonable transaction fees will prompt users to look for alternative payment methods or alternative platforms altogether.

Information Exchange #

Platforms where information is the main exchange, the experience primarily focuses on publishing and communication tools. Social media platforms, where the information exchange is one-to-many, heavily emphasize the tools necessary for producers to create/publish content and consumers to view, like, comment on, and share this content.

Relationship-building platforms, where information exchange is one-to-one, primarily rely on direct communication tools (e.g., messaging). Because of the intimate interaction, the ideal experience is designed around privacy and security.

The goal is to leverage the initial exchange as an entry to provide the tools and services to maintain that relationship.

Designing for Repeat Usage & Growth #

After an initial transaction, users can make a decision informed by experience on whether they’ll come or go elsewhere when looking for a similar value unit. There are two primary reasons for users to return: 1) they want/need to repeat the core transaction, or 2) they want/need to use your value-added services.

Repeating the core transaction #

The most significant impact on whether users will continue to use a platform is their experience in the initial transaction. Users completing a transaction isn’t an indicator of satisfaction with the experience.

Was the value unit delivered? #

No second chances here; if the consumer receives radio silence after paying, they will not be using your service again. It’s now up to the platform to ensure a refund is provided to avoid further brand damage.

Was it delivered on time? #

We’re living in a time where users are expecting instant satisfaction. If they order a product, they expect Amazon’s 2-day delivery. If they request a service, they expect the real-time status provided by Uber.

Did the value unit meet the expectations? #

If a user ordered a pizza, expecting a pie, and only received a slice — they probably won’t be trusting your food delivery platform again regardless of the why.

Was the transaction cost worth it? #

Sellers that aren’t happy with what they’re being charged at Amazon can move their business to Alibaba, where transaction fees for sellers don’t exist. However, by moving to Alibaba, they are now competing with sellers with similar products at a lower cost — Amazon knows this.

Platforms often make the mistake of depending on the exclusivity of their platform’s audience and technology. A competing platform will appear with a better end-to-end user experience if there’s enough demand.

(Don’t take my word for it, ask our friends at Blackberry.)

Re-engaging with supporting services #

You might find yourself in an industry where the re-engagement cycle is either longer than most or not expected at all. It is crucial to provide supporting services & tools that maintain users on your platform in these industries.

Take for example Thomasnet.com, a platform where industrial buyers find industrial suppliers that can be confidently integrated into their supply chain.

Once a match between two organizations has been made, it could be years before a need to use a b2b matchmaking platform resurfaces. By the time this need arises, they have either forgotten where they found their original suppliers or came across another platform to find their match.

Providing tools to maintain and facilitate the long-term b2b relationship is key for re-engagement. E.g., payments, order management, communication, etc. Adjacent markets can also be leveraged to keep users engaged. For example, these platforms may already have the audience necessary to provide talent acquisition-related features throughout their experience.

When no-repeat use is intended #

Hinge’s current tagline is “The dating app designed to be deleted.” If Hinge is successful at matching two users, they will not re-engage. If users re-engage, this is a sign that Hinge failed at an initial successful match.

A situation not unique to Hinge, this is something that all relationship-matchmaking platforms are aware of. But because the number of adults entering the long-term relationship phase in their lives is indefinite, these platforms can survive on a business model where success leads to no re-engagement.

There would be ethical and moral issues if platforms like Hinge designed an experience optimized to repeat the core transaction after a successful match. Nonetheless, it is possible to design for re-engagement without selling your soul.

Long-term relationships are inherently complicated. After a dating app like Hinge is deleted, there is an opportunity for these platforms to re-engage with the tools and services necessary to help maintain a healthy relationship. E.g., An app like Relish goes hand-in-hand with an app like Hinge.

Measuring Success #

The true success metric of any platform is revenue. However, to scale a platform effectively, it is critical, if not more important, to identify the platform engagement metrics that could give us the “x to sales” conversion rate.

Historically at Thomas, we measured platform success by the number of times a buyer contacted a supplier. On paper, RFIs (requests for information) sent made sense — after all, our job is to match buyers with suppliers. We laser-focused on this metric and more than doubled our monthly RFI submissions over the course of two years.

However, the increase in RFIs sent did not directly impact revenue. We realized that we were focusing on the wrong metric while using a traditional single-sided funnel approach to track success for a multi-sided platform. It was the equivalent of a waterpark measuring success by the number of visitors it sends down a water slide. Whether they made it down safe or not, we weren’t sure.

Tracking RFIs sent was the equivalent of a waterpark measuring success by the number of visitors it sends down a water slide. Whether they made it down safe or not, we weren’t sure.

Below are the four areas that represent the vitals of a multi-sided platform. Note these are focused on the metric category; the specifics and how they’re tracked will vary depending on the platform and revenue model.

Metric #1: Successful Matches #

A multi-sided platform delivers value when a successful match is made between a consumer and a producer. Succcessful matches is the leading indicator of revenue generated by a platform — it’s the single most important metric of how a platform is performing. To build on my previous analogy, a water park delivers value when visitors go down a water slide and arrive safely in the wading pool.

For Product & Service Exchange Platforms #

For product and service exchange platforms, defining a successful match is straightforward — a successful match occurs when money is exchanged for a product or service. The match quality can be gauged by the rating users give; assume a successful match unless either user gives a low rating in the exchange.

For Information Exchange Platforms #

Because of the nature of Information exchange platforms, determining a successful match tends to be more subjective and specific to the platform. For example, dating platforms could decide that a successful match is when two users connect with each other and delete the app. But would they still consider that a successful match if one or both of the users resubscribe to the platform a few months after? What about five years later?

On the other hand, social networks and other one-to-many platforms depend on a culmination of micro-interactions throughout their experience. Because the revenue model of these platforms is primarily based on advertising, the go-to metric of success tends to be active users. However, this broad metric fails to provide any insight that will lead to the sustainable.

A lesson Pinterest’s growth team learned early on.

I remember at Pinterest, at one point our growth team decided that the metric that they were going to base their success on, their OKR, was monthly active users … It’s a shame when you’re focused on the wrong things. When the growth team realized this and ended up changing their OKR to be what we called weekly active pinners—actually making someone who signs up for Pinterest not just come to the site once in a month—but pin something once in a week, their entire roadmap changed and we were able to make the people that we were signing up far more successful and happier and better long term engaged users.

Sarah Tavel, Founding PM at Pinterest, The Knowledge Project Ep. #113

A true successful match metric is determined by the balance of user & business value delivered contingent on the platform’s purpose with a direct correlation to revenue.

Metric #2: Audience Interactions #

Similar to how successful matches give us the conversation rate to revenue, audience interactions give us the conversion rate to successful matches. An audience interaction is when users from either side of a platform interact either directly or indirectly with users from the other side with the intent to match.

For example, buyers on Thomasnet.com can view videos of the products and services offered by suppliers listed on the platform. Although a video view cannot be considered a successful match, it is an indirect interaction between a buyer and the content of a supplier that can give us the probability of a buyer taking the next steps in contacting the supplier.

On product exchange platforms, an audience interaction is when a buyer views, saves, or adds a product of a seller to their shopping cart. On-demand service exchange platforms (e.g., Uber, Airbnb, TaskRabbit), tend to limit the interactions until the match has been made. However, post-match interactions are also strong indicators of whether a match will end with a completed transaction.

Not all audience interactions hold the same weight when determining the conversion rate to a successful match. These metrics should be broken out to a set of metrics specific to the platform’s purpose.

Metric #3: Active Users #

In the traditional sense, active users represent the number of visitors a website or app receives during a given time period (e.g., monthly active users). It’s a critical metric that serves as the leading indicator of audience interactions and, if the platform has an advertising revenue model, revenue.

With a network effect at play, more active users do not always lead to more successful matches for multi-sided platforms. The types of active users and the ratio between the different sides play a critical role in the conversion rate to audience interactions and ultimately to successful matches.

Active Buyer to Seller Ratio #

For example, let’s say we have 1,000 active buyers on a platform during the span of a week. We know the average spend of each buyer during the span of a week is about $50. This leaves us with an average spend of 50k a week from our buyer base. This is straightforward for traditional pipeline or single-sided businesses; growing our active buyers will lead to growing revenue.

Let’s introduce the seller into the equation. We have 100 active sellers on a platform during the same time period. Distributed evenly (for simplicity), each supplier ends up with $500 of the $50k produced by the buyers. This tells us that for every 10 buyers, 1 supplier generates $500 of revenue.

Suppose the platform charges a 3% transaction fee. In that case, we now know that 1,100 monthly active users with a 10:1 buyer to seller ratio generates $50k in transactions resulting in $1,500 of revenue generated by the platform.

If the ratio of 1,100 monthly active users changes from 10:1 to 9:2, transactions drop to $45k and revenue drops to $1,350. This gives a scenario where monthly active users remain the same, and revenue has dropped. Still with me?

Unchecked Growth #

Because of the network effect of a platform, growing the number of quality sellers will attract more qualified buyers (and vice versa). However, unchecked growth on either side results in a negative network effect .

If we grow the number of active sellers, each seller will now receive a smaller piece of the pie. By increasing the number of active sellers by 100, we’re looking at 1,200 monthly active users with a 5:1 buyer to seller ratio. Although transactions and revenue stay the same, each seller now generates $250 a week instead of the original $500. If sellers see little value, they will take their business elsewhere.

Only growing the number of active buyers, a platform will reach a point of infliction where sellers won’t be able to meet demand effectively. This will result in either a drop in quality of the delivered product/service or a base of suppliers that cannot fulfill. Buyers will be left with no other choice but to buy through a competing platform.

The reality is that a platform will never hit the brakes on a growing user base — nor should they. The best that can be done is to keep track of the active user ratio and redirect the user acquisition efforts. However, the trick to getting the correct balance is measuring user trust and happiness.

Metric #4: User Trust #

The more users trust your platform, the more likely they will continue to engage and recommend it to others. Well-defined and collected user trust metrics give the additional context necessary behind the conversion rates across all touchpoints of a platform.

For example, if we’re analyzing the performance of a company profile page/template, part of what we look at is the conversion rate to contact (what percentage of total company profile visitors went on to contact a supplier). A conversion rate of 20% gives us no indication of whether that’s a good or a bad number.

If along with a 20% conversion rate, we also know that user trust in the company profile page is an average of 1.8 out of 5. Along with ratings, users are also given the option to provide comments. We now have better context toward the company profile’s conversion rates to contact. This won’t tell us the full story, but it gives us a better starting point for optimizing a platform’s overarching experience.

To conclude #

I set out to share the knowledge of platform design that I’ve accumulated over the past few years as the head of design of one of the oldest two-sided platforms in the world. But as you can tell, multi-sided platforms are a vast topic.

I’ll be following up with a deep dive into topics I didn’t cover such as platform governance & disintermediation. Probably more of a reason for you to subscribe to my articles. In the meantime…

Resources #

I put together a separate page for books, articles, and case studies I’ve found useful on my journey to designing multi-sided platforms. Enjoy!

I'm Julian, a product design leader and developer with a habit for experimenting (I did some cool stuff at Thomasnet.com). I mostly write about what I'm working on related to product design, front-end development, and experimentation.

While you're here, I'm currently in the market for a design leadership gig. If you're interested in working together, hit me up, or feel free to share my resume.

Notes From the Field

Designing Multi-Sided Platforms

A comprehensive guide on designing the experience and growing the engagement of networked markets.

A Pragmatic Approach to Design Principles

How we took our design culture from executive-centric to user-centric with the help of pragmatic design principles.

Server-Side Split Testing for Static Websites

When to use, when to avoid, and setting up your A/B testing stack.

How We Adopted CSS Grid at Scale

From team buy-in to fallbacks, here's the approach we took at Thomas with the implementation of CSS Grid.

Don't Fight The Notch — Designing for the iPhone X

Coming to terms with the notch on the iPhone X and its effect on mobile design.

Lessons Learned After Running 300 A/B Tests on 20 Different Websites

Over the past 2 years I’ve dedicated part of my career to building a conversion rate optimization (CRO) team from the ground up. Here's what I've learned.